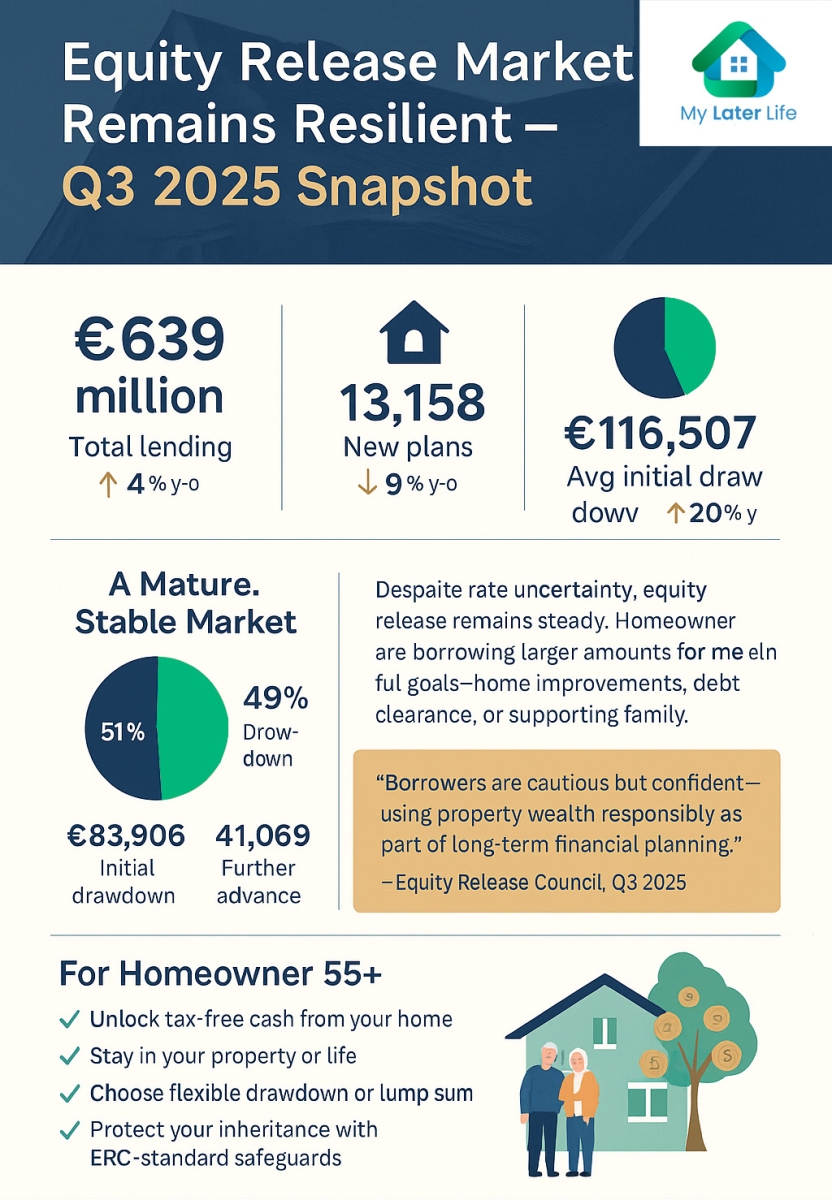

Equity Release Council Q3 2025 Report: Market Remains Resilient Amid Rate Uncertainty

Published: November 2025 | By My Later Life

What This Means for Homeowners

For people aged 55 and over, these figures show that equity release and lifetime mortgages remain an important way to unlock housing wealth — but clients are more selective and thoughtful about when to act.

Many homeowners are using property wealth to:

Clear existing mortgages or debts

Fund home improvements or adaptations

Support family financially

Supplement retirement income

This careful approach highlights a growing awareness of how later-life lending can be part of broader retirement and estate planning.

How My Later Life Can Help

At My Later Life, we’re here to help you make sense of the market.

Whether you’re ready to explore your options or simply gathering information, our advisers will:

Explain how lifetime mortgages and drawdown plans work

Compare products from across the market

Show how current rates and trends may affect your decision

Help you make a choice that fits your goals and protects your long-term interests

We’re proud to be regulated by the Financial Conduct Authority and aligned with Equity Release Council standards, ensuring our clients receive transparent, ethical, and responsible advice.

“Despite uncertainty, later-life lending remains strong — showing confidence in the market and in the value of property wealth as part of retirement planning.”

— Equity Release Council, Q3 2025 Report

In Summary

The UK equity release market continues to adapt to new conditions — smaller in volume, stronger in value. Borrowers are taking measured decisions, using their housing wealth to support meaningful life goals.

If you’re wondering what this means for you, talk to us at My Later Life. We’ll help you understand whether now is the right time, what options are available, and how to make the most of your home’s value safely and confidently.

???? Get in touch: www.my-laterlife.co.uk

?? Book your free consultation today